WeChat ID :

Login/Register

Here's the English translation of the article:

🐮 AG: Hey, Ex! I'm about to sign a lease contract, but the owner wants my parents to be the contracting parties instead. Is that possible?

🧸 Ex: Yes… They can provide a power of attorney from the owner. If it's a family member with the same last name, it usually isn't a problem.

🐮 AG: The owner has multiple units—some are under the father's name, some under the mother's name.

🧸 Ex: Oh, so this is a way to avoid personal income tax, huh?

🐮 AG: Uh… M-maybe? 😅

🧸 Ex: If that's the case, I recommend the owner register it as "Right over Leasehold Asset" (ทรัพย์อิงสิทธิ) instead.

🐮 AG: Right over leasehold asset? What's that? Never heard of it.

🧸 Ex: Gather around! Let me break it down for you—everything about this legal concept in one go!

The term in English is Right Over Leasehold Asset.

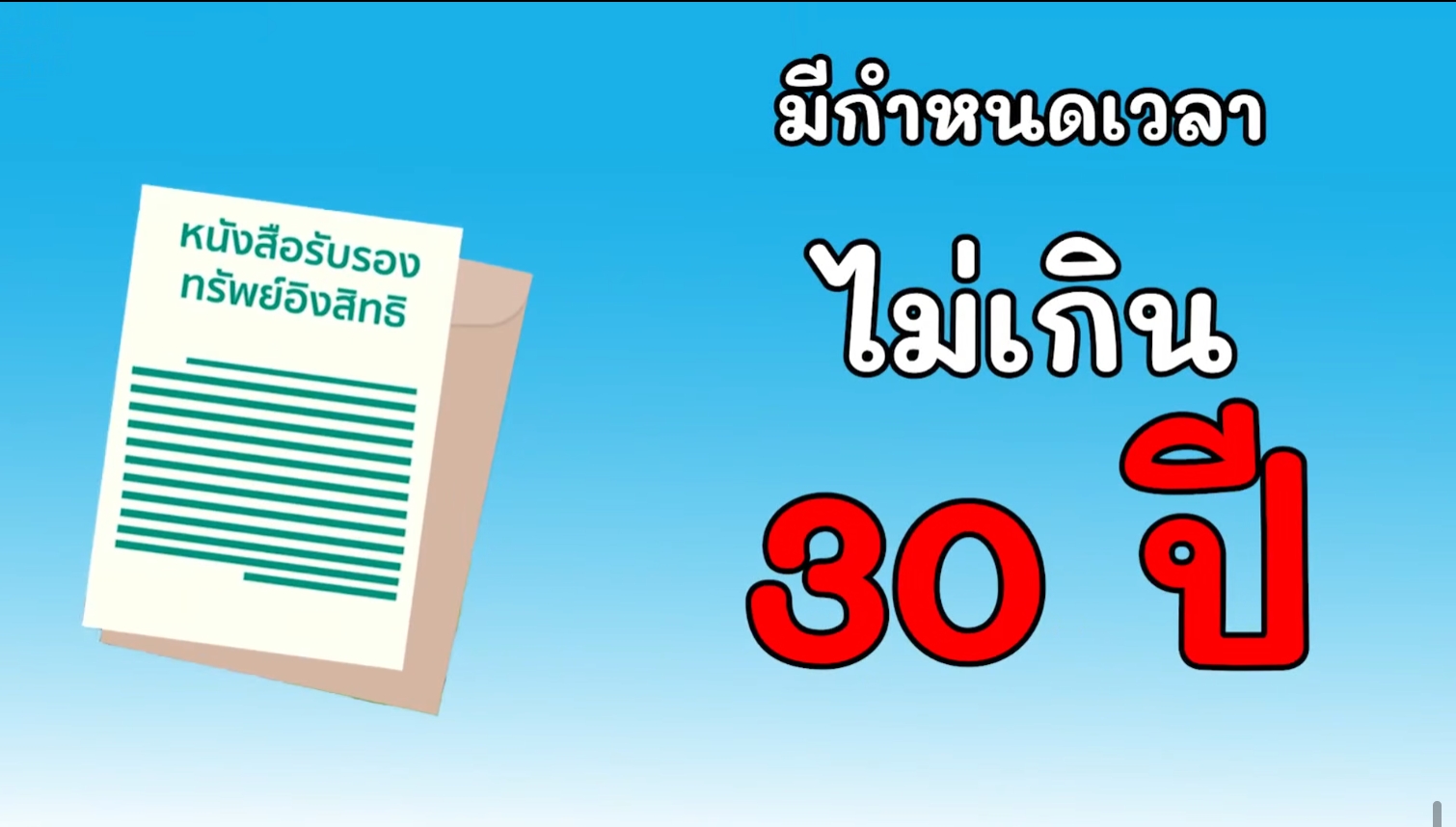

✅ It's a type of real estate lease agreement developed under the Right Over Leasehold Asset Act B.E. 2562 (2019) to provide more flexibility in real estate utilization.

✅ The property owner grants another person the right to use or manage the asset as agreed, without transferring ownership. The right comes with conditions specified in the contract, such as duration and purpose of use.

✅ The person who benefits from this right is called the "Right Holder" (ผู้ทรงทรัพย์อิงสิทธิ) or simply the "Holder" (ผู้ทรงสิทธิ).

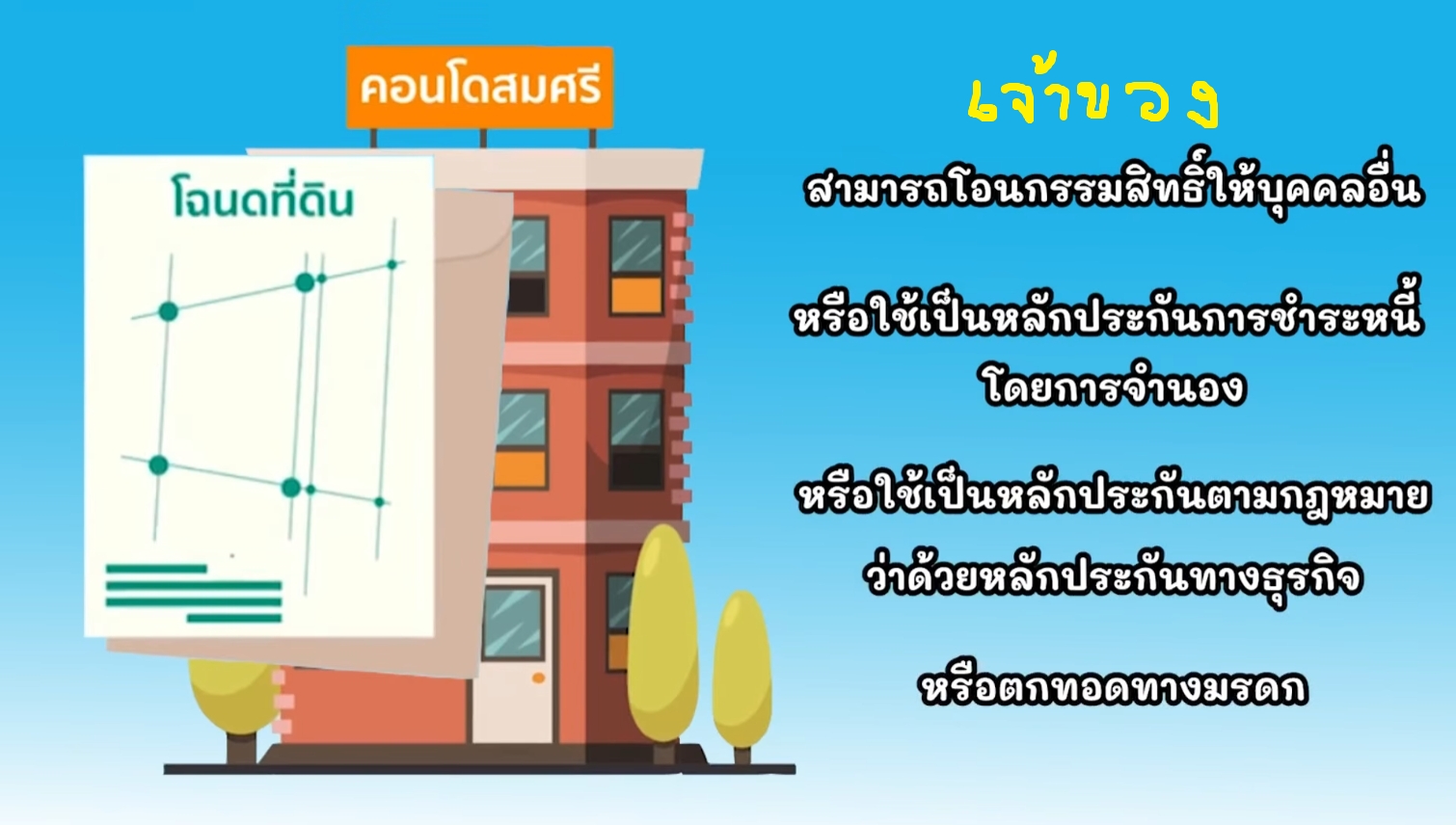

✅ The Holder can use, improve, or transfer the rights freely and even mortgage the leasehold right as collateral.

✅ When the contract expires, the leasehold rights revert back to the original property owner.

🚨 Important Distinction: Ownership vs. Rights

With Right Over Leasehold Asset, you have almost all the rights of an owner but do not hold ownership of the property itself.

🐮 AG: How is this different from long-term leasehold?

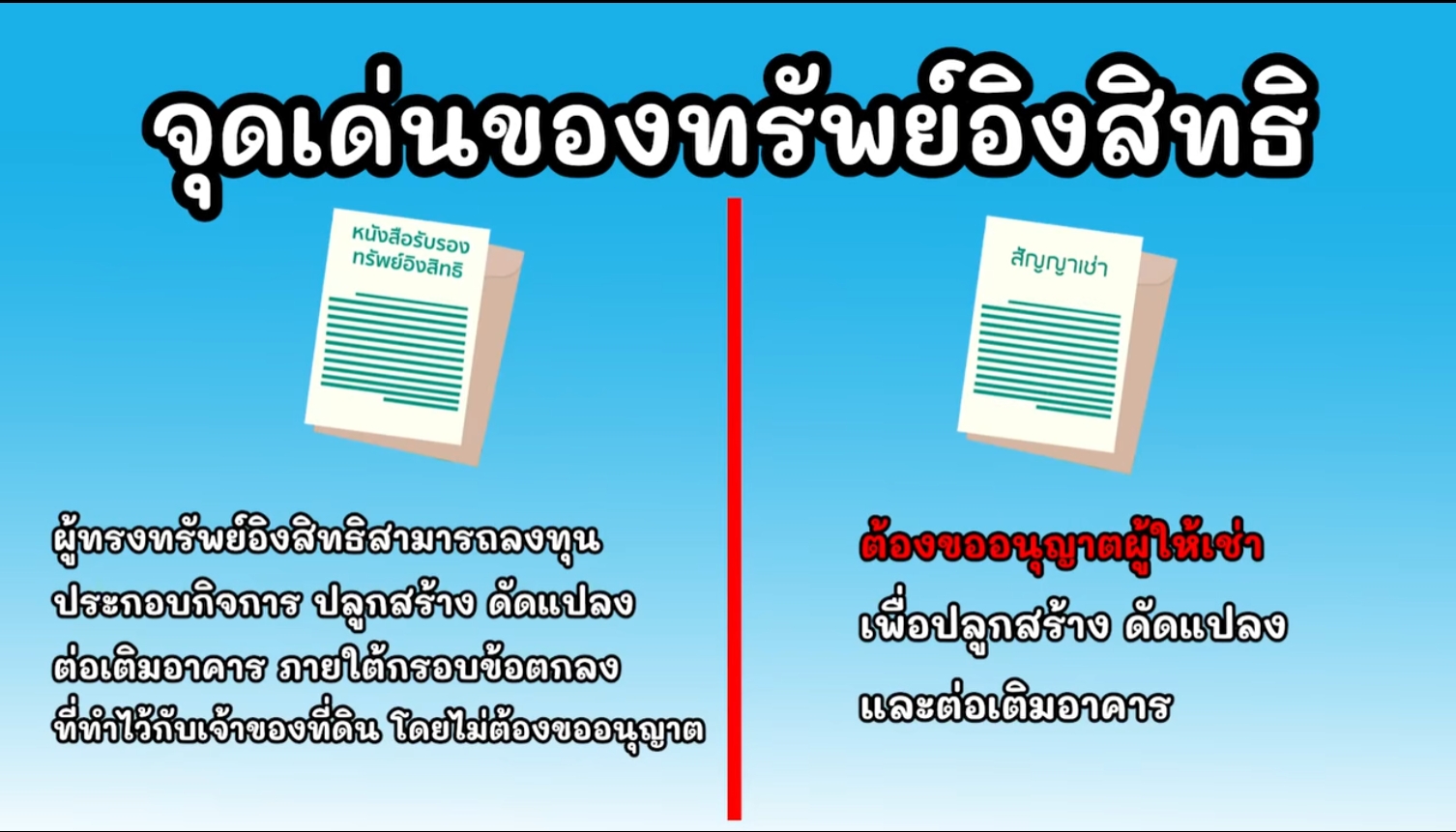

✔ Right Over Leasehold Asset → The Holder can construct, modify, or fully utilize the property without needing the owner's permission.

✖ Leasehold → The tenant cannot modify or transfer rights without the owner's approval.

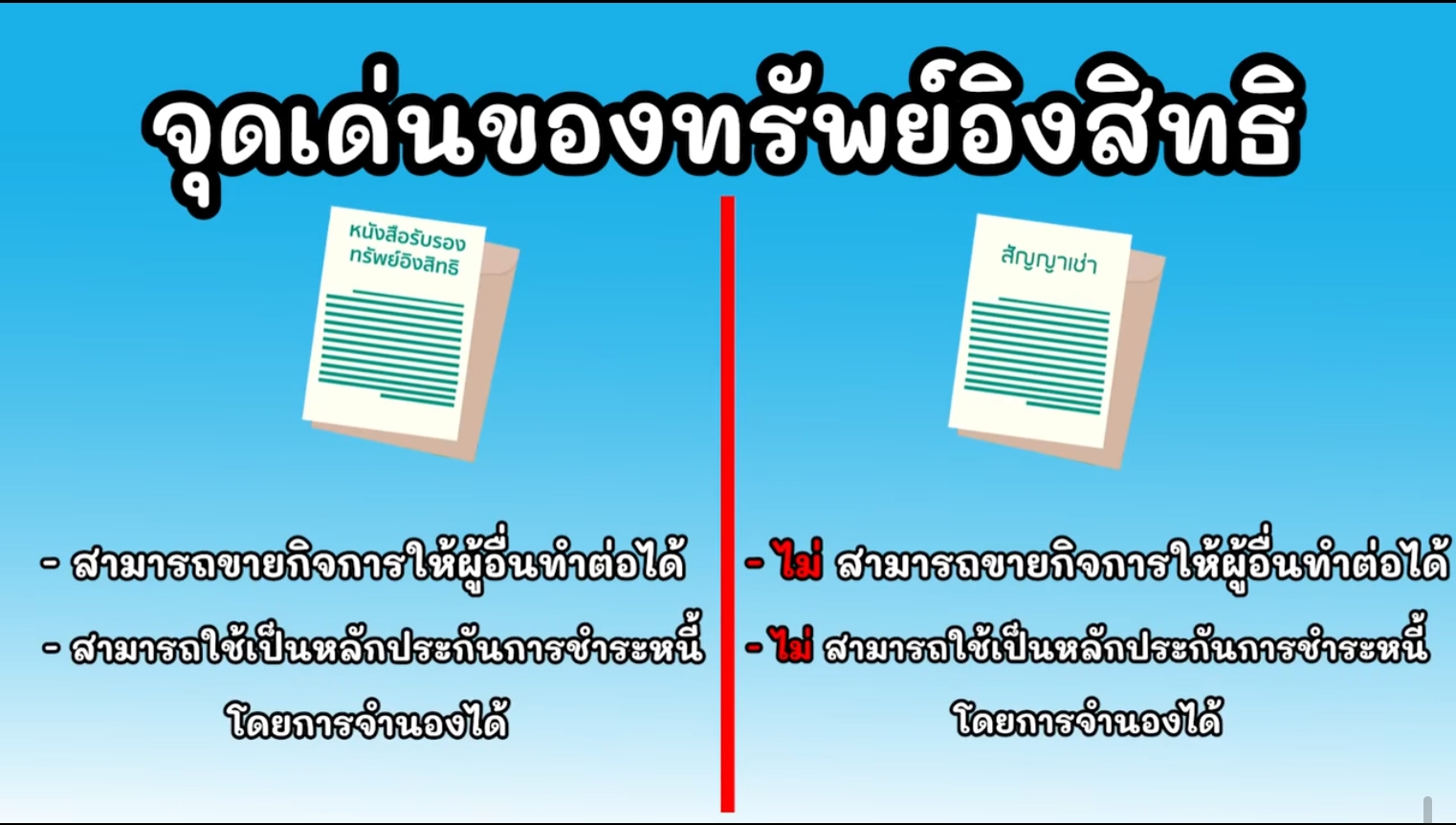

✔ Right Over Leasehold Asset → The Holder can transfer or mortgage the right as collateral.

✖ Leasehold → The tenant cannot use the leasehold as collateral.

✔ Right Over Leasehold Asset →

✖ Leasehold →

✔ Right Over Leasehold Asset →

✖ Leasehold →

✔ Right Over Leasehold Asset → Survives even if the original owner dies or sells the land.

✖ Leasehold → If the owner sells the land without lease registration, the tenant may lose their rights.

✔ Both Right Over Leasehold Asset and Leasehold require registration with the Land Department for legal enforcement.

✔ Right Over Leasehold Asset:

✖ Leasehold:

🐮 AG: So, how does this help with tax savings?

Using Right Over Leasehold Asset is not considered a transfer of ownership, so the landowner remains the official owner and does not generate taxable income from a sale.

However, if the Holder leases out the property or earns income from it, they must pay personal income tax.

This method has been used for tax planning—wealthy landowners transfer rights to their children or lower-income family members to spread income and reduce tax burdens.

🐮 AG: What happens if either party passes away?

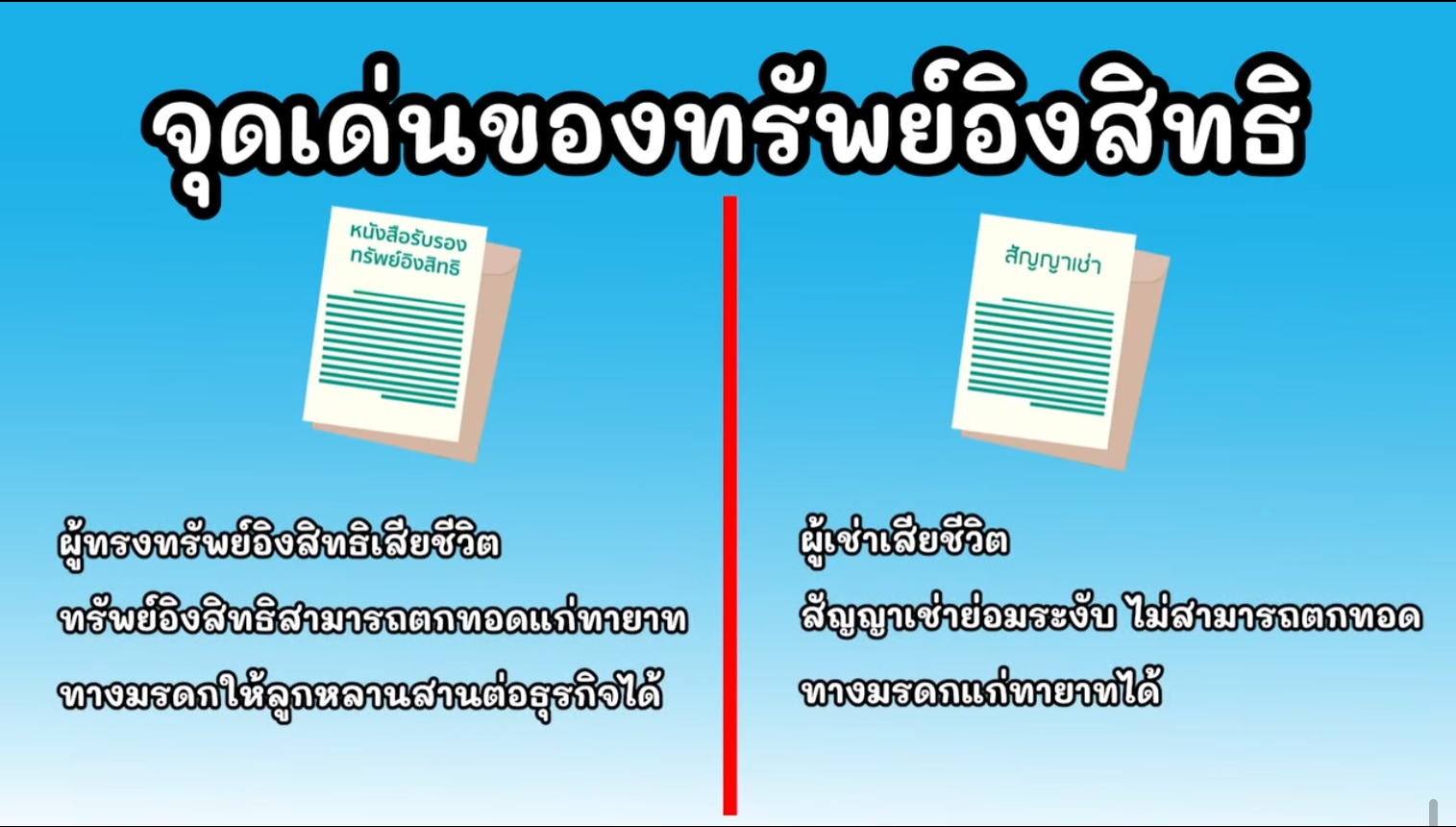

✅ If the property owner dies, the rights remain intact under inheritance laws.

✅ If the Holder dies, the rights can be passed to heirs as part of their estate.

🐮 AG: You mentioned the Holder can mortgage the asset. What if they default on debt? Who is responsible?

✅ The property owner is NOT liable for the Holder’s debts unless they explicitly agreed to use the property as collateral.

✅ The Holder is fully responsible for repaying the mortgage. If they default, the bank may seize the mortgaged leasehold right but not the land itself.

✅ To prevent risks, the contract can explicitly forbid the Holder from mortgaging the asset.

🐮 AG: What if the owner still has doubts or fears about this process?

🧸 Ex: Just consult the Land Department—end of discussion!

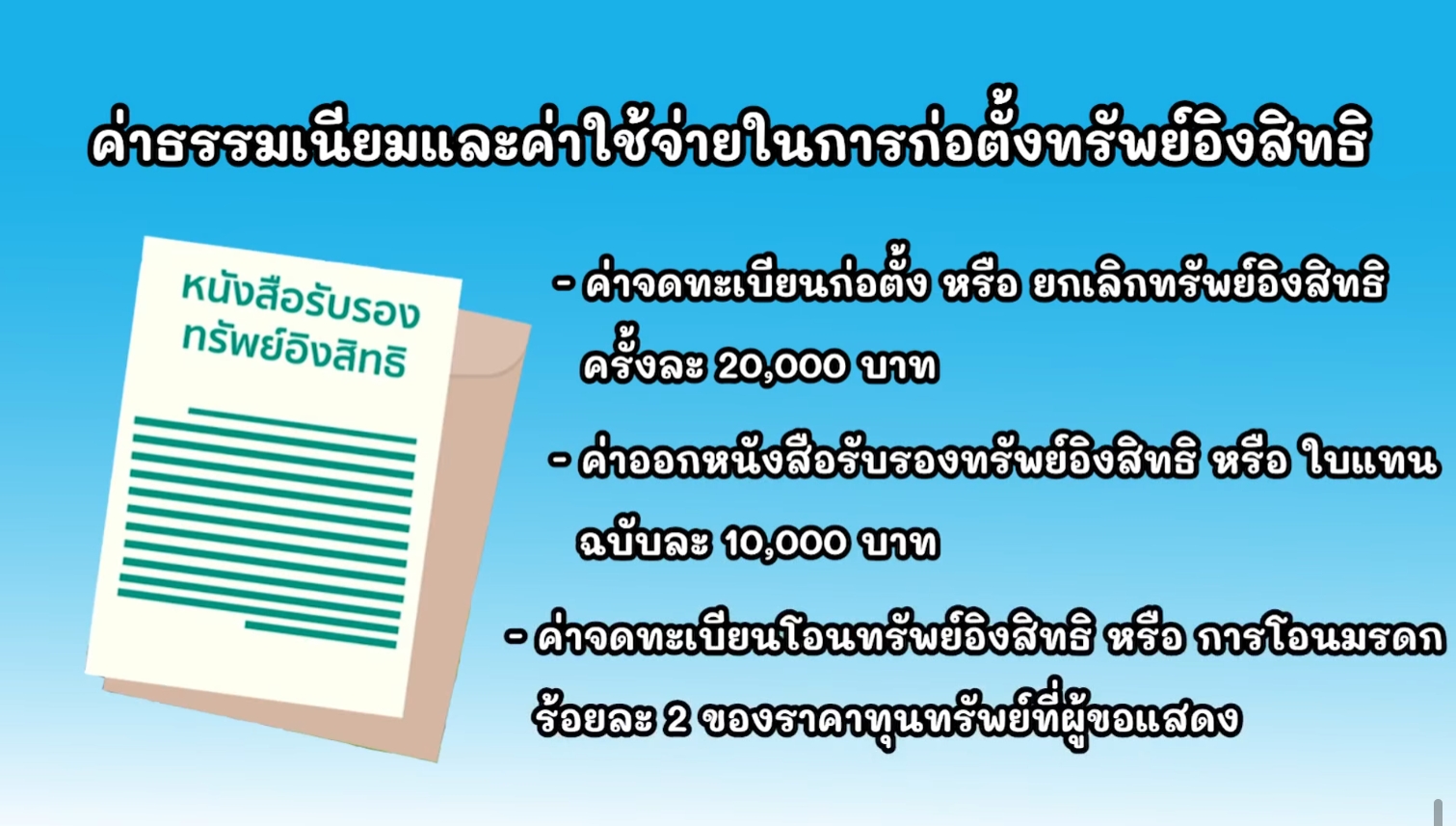

Right Over Leasehold Asset is a relatively new law introduced in the past few years, so many people are unfamiliar with it. However, it's a 100% legal transaction because it requires official registration with the Land Department.

For those who understand how to use it, it offers significant financial and legal benefits. However, some exploit this method to favor foreign investors, raising concerns about it being a loophole for indirect foreign property ownership (which we won’t discuss here).

Parinwat K. (Ex)

Managing Director, Matching Property Co., Ltd.

AKA: "The Romance Agent in Huai Khwang"

Specializes in sales, rentals, mortgage & property transactions in Bangkok, metropolitan areas, and key economic cities.

With nearly 10 years of experience handling high-value and complex real estate cases, ensuring successful transactions that benefit all parties.

Cr. Illustrations:

Marketeer Online, Land Department Fanpage

.

Join the discussion at