WeChat ID :

Login/Register

What?! This Condo Project Sold Out in Just 2 Days?!

Whoa!!! This project sold out in just 2 days?! Wow!!! That location launched at 2xx,xxx THB/sqm. Who's buying? How could they sell it at such a high price? Where does their confidence come from?

These are the thoughts that cross my mind every time I see news about a condo project selling out. Why are people lining up? Is there really something so special about it? At that price, for that location, I wouldn’t buy it. It’s not that I don’t have the money (because I still have my kidneys 😁), but based on the data I have, it’s not that impressive.

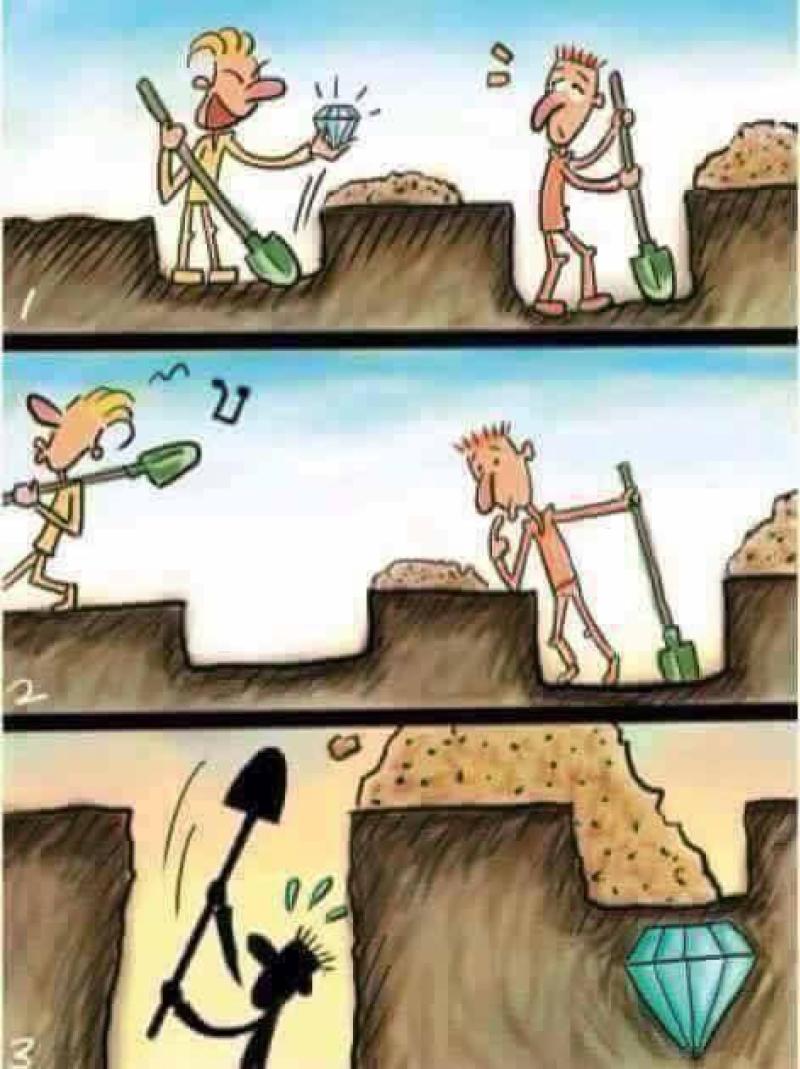

Why do I always think differently from others? Is it because I lack the vision to see far ahead? Am I still stuck in the mindset of someone without wealth? Or do I just not understand investor behavior well enough? Do they know something I don’t? Am I overlooking something? To put it simply... "Am I just too dumb to get it?"

These questions have been on my mind for a long time, and I don’t know who to ask. Asking too many questions makes me feel intrusive. Everyone has their own responsibilities and work to do. Spending money on courses doesn’t always help, because sometimes they don’t tell you everything. So, in the end, I had to seek the answers myself.

After learning from P’Vo (Insocondo), I finally understood what I had been questioning all along. P’Vo explained project analysis very clearly. The image I had in my head became sharper and clearer.

It turns out my common sense wasn’t entirely wrong. Many projects that create a buzz are artificially hyped. Who does that? The developers themselves. They build a perception to drive up prices, selling dreams to buyers who imagine great returns.

Throw in some attractive, sweet-talking salespeople, and people lose their reasoning. By the time they realize what’s happening, they're stuck trying to offload worthless reservation papers.

I have a stack of reservation contracts from people trying to sell. For one particular project, I hold 10% of the building’s units. Honestly, I don’t even know who to sell them to. Even at a loss, they’re hard to sell—unless someone equally blind buys them.

Knowing what I know, it’s frustrating to even try selling them. So, just as there are stock market amateurs ("moths"), there are plenty of condo market amateurs too.

Buying a reservation contract and hoping to flip it quickly is very risky now. New condos are being launched constantly, with countless units entering the market. There are so many options available now.

Unless your unit’s position is truly premium, it’s going to be tough to sell. The pros in this game already have target numbers and locations in mind, even before the pre-sale starts.

If you’re just sitting at the counter listening to a salesperson, you’re already too late.

That’s why thorough research is necessary. Think, analyze, and evaluate carefully.

What is your purpose for buying a condo?

The positioning and price of the unit will vary, including the type of project you should buy, depending on your goal.

Even if you’re buying for yourself, consider the resale value at least 20%. Why? Because people move.

If you focus only on "price" and ignore everything else, that cheap unit might not be the best deal in the long run.

Sometimes, paying slightly more gets you a much better investment. For example:

Two 10M THB units: One at 10.2M in a terrible position with a blocked view, and another at 10.7M with a premium floor, an unbeatable view, and a prime location. Which one do you think high-end buyers will choose? The 10.7M unit, obviously.

Luxury brand condo (28 sqm) vs. a mid-tier condo (45 sqm) at the same price: Someone with 10M THB won’t want to live in just 28 sqm. The 45 sqm unit wins.

For budget condos in the 1-2M range, the priority is low price. These buyers are looking for their first place to call home. But when it comes time to resell, they often struggle, realizing they must sell at a loss.

On the other hand, if a unit has a good price and a prime location, it will be a good investment and easy to resell.

So, understanding the behavior, context, and mindset of different income groups helps you read the property market better.

Many gurus emphasize Location, Location, Location. I believe this only halfway. Why? Because the quality of a location depends on its surrounding environment. That is the real factor that determines a location’s potential.

For example: Ladprao Road, from Central Ladprao to The Mall Bangkapi

So, even along the same road, different areas cater to different demographics. Rich people in early Ladprao won’t shop at Central Ladprao. They take the expressway to EmQuartier or Siam. People near Imperial Big C go to The Mall Bangkapi instead.

Now, if a luxury condo launches in Big C Ladprao at 4.9M THB, and claims to be the new landmark with high rental potential at 25,000 THB/month... If you fall for that sales pitch, get ready to fly. Not upwards, but straight into a financial trap.

Why? Because rich people don’t live near Big C Ladprao! That area is full of blue-collar workers, mall staff, and regular salary earners. Who’s going to rent a condo for 25K a month there?

See what I mean? The location itself is meaningless if the surrounding demographics don’t support it.

The property market is a game of observation. You must analyze buyer behavior and economic class differences.

Not every high-end condo needs to be next to a BTS station. For example, in Thonglor, parking space is more important than a BTS station. Wealthy buyers prefer sitting in their luxury cars in traffic over cramming into a train.

Understanding context and consumer behavior is the key. It will help you grasp why some locations boom while others collapse.

Thanks to P’Vo for the knowledge, helping me see through developer tactics, and making smarter real estate moves. Your teachings won’t go to waste. 🙏

.

Join the discussion at

https://www.facebook.com/Ex.MatchingProperty/posts/pfbid0aAcrALuxVSX7HeMv6S4yjiZHTdoYT556X15EVrJxUJKn9MZ7djqPLKsvvvyUd9zLl