WeChat ID :

Login/Register

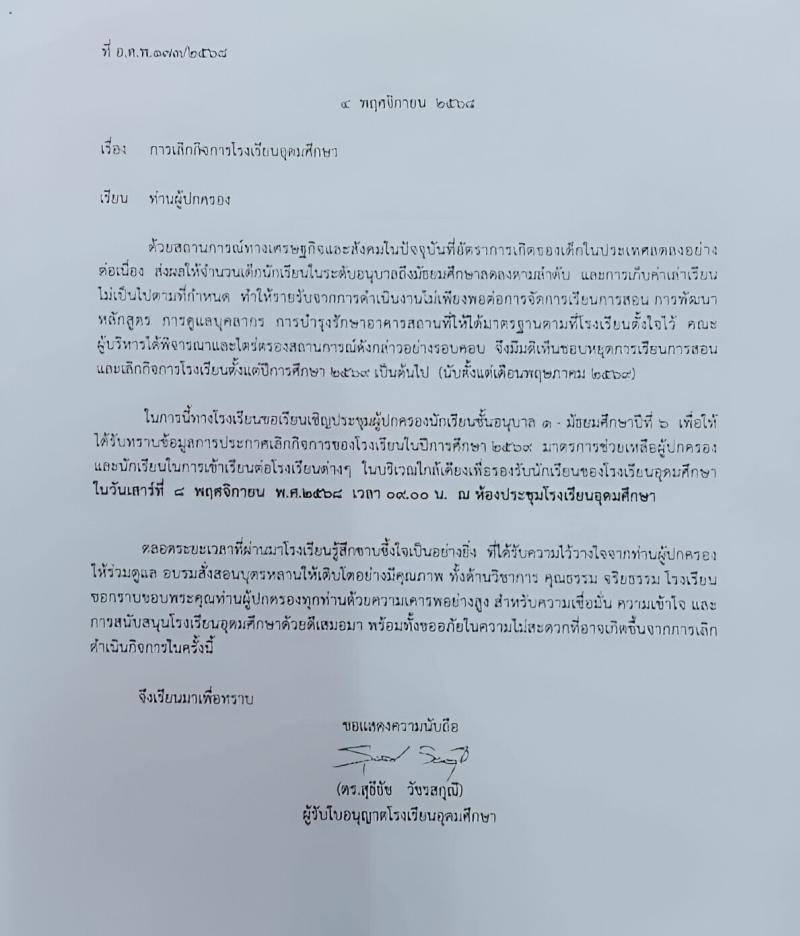

The Decline of a Prestigious Ladprao School — and the Future of Thai Education

.

With Thailand’s struggling economy and declining birth rate,

a well-known school in the Ladprao area has announced its closure

after more than 50 years in operation.

The board has approved the termination of teaching and operations

starting from the academic year 2026 (May 2026).

.

For many Thais, this signals a bleak future for the country’s education industry.

But interestingly, foreign investors I’ve met

see the opposite.

To them, Thailand is the “Education Hub” of Southeast Asia —

and some even envision it as a gateway to all of Asia.

Because there’s still real demand —

from three key groups:

.

1️⃣ Upper-middle Thai families

who want international-standard education

at a more affordable price.

2️⃣ Foreigners relocating to Thailand long-term,

including digital nomads, startup professionals, and health tourism families.

3️⃣ Students from CLMV countries

(Cambodia, Laos, Myanmar, Vietnam)

who view Thailand as a gateway to higher education.

.

Thailand remains a safe zone —

low cost of living, English-friendly,

moderate legal systems,

and an appealing lifestyle.

So, foreign investors don’t just see Thailand as a domestic market —

they see it as a launchpad to expand into ASEAN and Europe.

.

1️⃣ Complex ownership laws

Thai law requires schools to have at least 50% Thai shareholders

and a Thai director/manager.

Land must be owned by Thai nationals or held under a long-term lease.

Tuition fees can be regulated or capped by the government.

In short — even if you have the money,

you can’t just walk in and open a school.

.

2️⃣ Demographic paradox

Birth rates are falling — the mass market is shrinking.

But the premium market is growing.

Parents are willing to pay for quality.

Those who focus on quality win.

Those who chase quantity fail.

.

3️⃣ Data privacy laws (PDPA)

EdTech companies must now comply with Thailand’s data protection act.

Starting 2024–2025, enforcement has become serious.

If your platform isn’t PDPA-ready,

expect a visit from regulators before the first term begins.

.

1️⃣ International / Bilingual Schools in Secondary Cities

Chiang Mai, Phuket, and Pattaya are booming

as more foreigners settle permanently.

Schools offering British or Singaporean curricula

with full-service packages (meals, transport, activities)

are growing quietly but steadily.

.

2️⃣ TNE (Transnational Education) Partnerships

Collaborations with global universities

offering specialized programs like AI, clean energy, engineering, health tech.

Thailand already supports this through BOI incentives and LTR visas

for foreign experts.

The right partnerships = guaranteed success.

.

3️⃣ EdTech for Adult Reskilling / Upskilling

This is the fastest-growing segment.

Professionals aged 30–50 must now relearn everything —

languages, digital tools, new regulations.

Platforms that provide measurable results

and comply with PDPA

can partner with corporations, SOEs, and government agencies.

.

Those entering the market expecting to scale by student volume —

rather than focusing on trust and quality —

will fail fast.

Because education in Thailand

is not a “building-based business.”

It’s a “belief-based business.”

The key product isn’t a classroom — it’s confidence.

.

Join the discussion:

https://www.facebook.com/Ex.MatchingProperty/posts/pfbid06uAjXvJ99t5D4w3jauGksL6VuUosgx2uj9ZPkYassvbHf2t2rLq7QKXKxQyobjrdl