WeChat ID :

Login/Register

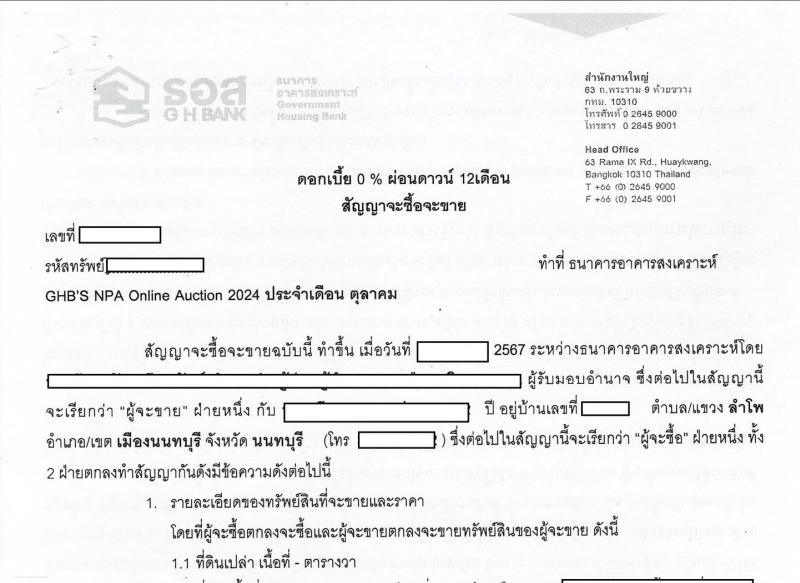

I’ve just read the NPA property purchase agreement

that allows installment down payments over 12–24 months from the bank.

.

From what I’ve reviewed,

I think the bank itself

might need to tighten the contract wording —

to prevent another case like Oh on Hon Krasae.

.

For example,

the contract should explicitly prohibit overlapping transactions,

or clearly define that certain actions

constitute a breach of the down payment agreement,

beyond just defaulting on monthly installments

or failing to redeem after the contract period ends.

.

Or, if the bank’s stance

is simply to focus on selling NPA assets directly to the public,

and views what happened on Hon Krasae

as an issue between the intended buyer (Oh)

and the sub-buyer (the victim),

then perhaps the bank itself

is not responsible for that specific transaction.

If that’s the bank’s policy direction —

so be it.

.

(I do understand how public institutions operate —

their roles, responsibilities, and legal boundaries.)

.

As for Oh’s business model,

many pages have already discussed it.

In some aspects, Oh wasn’t entirely wrong.

In others, the buyer made mistakes too.

And in some cases, even Lawyer Pakiew

may have misunderstood the full story.

It’s like a roundtable

where everyone holds a knife.

No one is 100% clean.

Each party knew only part of the conditions.

But the problem became public

because Oh, as the head of the table, made a mistake.

And once that happened,

everything fell like dominoes.

All those knives pointed

right back at Oh inevitably.

.

As someone who’s been in this industry for years,

I’ll summarize the whole picture from every angle

tomorrow.

.

P.S. Thanks to all the FCs who sent me the contract to review.

.

Join the discussion at:

https://www.facebook.com/Ex.MatchingProperty/posts/pfbid0Pwr84fuqgWcTaf9DQzTt7o533mARHeZkQEMZSSh4v1srkJK4Kp9XzoovmuL7nQncl