WeChat ID :

Login/Register

From the previous article.

I mentioned that.

If you haven’t missed any car installment payments.

But feel you can’t continue paying.

Or no longer use the car.

You can return the car to the finance company.

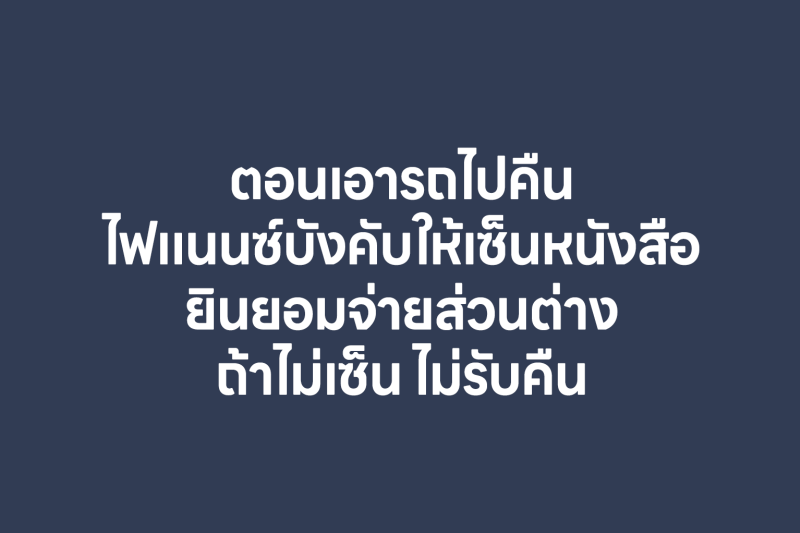

However, many followers reported that.

The finance company refused to take the car back.

And demanded that they sign an agreement.

To accept responsibility for any balance due.

If they didn’t sign, the company wouldn’t accept the return.

So what can the hirer do in this case?

.

File a daily record report.

At your local police station.

Tell the duty officer that you wish to return the car.

But are being forced to sign an agreement to pay the balance.

Bring that police report to the Legal Execution Department.

You must go to the branch located where the finance company is registered.

(Not just any branch.)

Bring your hire purchase agreement and a copy of the vehicle registration book.

Then file a “deposit request” (คำร้องขอวางทรัพย์).

Explain to the officer why the finance company refused to accept the return.

You should prepare all related details before you go.

After completing all the procedures.

The legal effect is that the contract is considered terminated immediately on that day.

And most enforcement officers.

Will allow you to take the car back home.

Without having to continue making payments.

If the finance company threatens you.

By claiming you’re committing “misappropriation of property.”

Don’t worry.

Wait for the official court summons.

Then file a written defense to contest the claim.

Reference document.

“Announcement of the Contract Committee on Hire Purchase Business for Automobiles and Motorcycles.

as a Controlled Contract Business, B.E. 2565 (2022).”

This is the regulation that all finance companies must comply with.

And the court can dismiss the case based on it.

Relevant Supreme Court rulings.

(Dika Case No. 31/2560).

(Dika Case No. 944/2568).

Cr. Content credit: Lawyer Peer Chaiyahan.

Join the discussion at.

https://www.facebook.com/Ex.MatchingProperty/posts/pfbid0SEYAAuv1er1dqsya8MkQTfppwZ2HQJCmd1dYPszA5Kkf8ifJx4xuiCm87CbxKgj4l