WeChat ID :

Login/Register

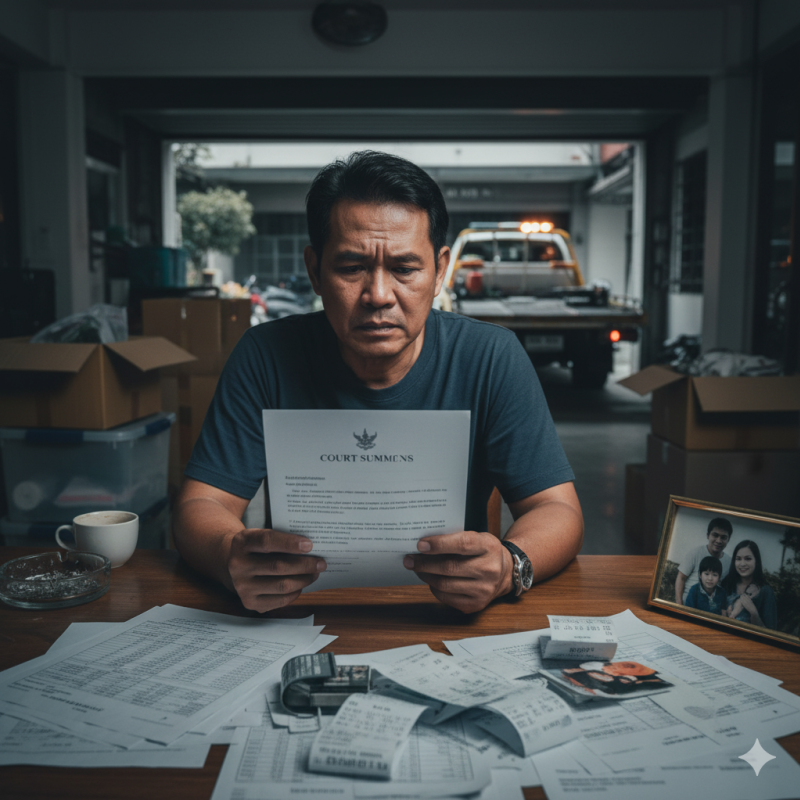

I didn’t expect that the post

“Some finance company policies state that

if a debtor defaults for more than 3 installments

and the car’s deficiency balance exceeds 1 million baht,

the creditor may file for the debtor’s bankruptcy.”

would receive so much attention.

Many followers sent questions,

so this post will clarify everything again.

(Even I can’t find my original comment anymore.)

Yes, you can.

But there are two cases:

1.1) Return with unpaid installments.

If the finance company sells the car at auction and there’s a shortfall,

they can collect the remaining balance from you.

(According to the 2022 hire-purchase standard contract by the OCPB.)

1.2) Return without any overdue installments.

If the car is sold at auction and there’s a deficiency,

the finance company cannot collect it from you.

(Supreme Court Judgment No. 1203/2565; Civil and Commercial Code §573)

You can drive it back —

but you must schedule, sign, and hand it over correctly.

Never just drop the car in front of the branch and leave the key.

2.1) Call the finance company and request a Voluntary Surrender.

Say, “I’m not overdue, but I wish to return the car.”

Request the date–time, handover location,

and list of documents (termination & delivery forms, etc.)

so everything is documented properly.

2.2) Prepare the car and documents.

Complete key set, remote, manual/warranty book,

original accessories, unpaid tickets (if any),

and current tax/insurance evidence.

Take photos or video: full exterior, odometer, and condition.

(Claimable damage = “actual, necessary, and reasonable only.”)

— OCPB restriction on unfair contract terms.

2.3) On delivery day, sign clearly.

You must have a vehicle handover receipt

stating date, mileage, condition, accessories,

and a termination/agreement letter.

Keep all copies.

2.4) After return,

the finance company must sell transparently,

and notify you at least 15 days in advance

of the first auction — including date, place, and starting price.

Any price reduction must be re-notified.

(OCPB Notice 2022, Clause 4(b))

And the company cannot bid directly or indirectly in its own auction (Clause 5).

2.5) Handling surplus or deficit.

If the car sells above the remaining balance,

the excess must be refunded to you.

If it sells below, you owe the difference:

overdue installments + future unpaid ones + collection costs before termination.

After termination, no unearned interest may be charged.

Results must be reported to you within 15 days after sale.

2.6) Permitted vs. prohibited charges.

OCPB forbids any clause making the lessee pay extra

after repossession, except:

installment penalties,

necessary collection fees,

actual VAT.

No arbitrary “cancellation fee” is allowed.

The creditor may enforce judgment and search for assets

for up to 10 years.

They may investigate:

Bank accounts (costly, rarely used)

Real estate, land, buildings, condos

Vehicles

If your monthly salary >20,000 baht,

the excess portion can be garnished.

Court orders will be sent to HR to deduct wages.

Other income:

Bonuses up to 50% can be seized.

Overtime & allowances up to 30%.

Welfare payments: 100%.

It can — depending on how the finance company reports it.

Credit Bureau updates monthly.

The new account status appears the following month.

Some records stay up to 3 years from closure.

If you never missed payments, returned properly,

and settled any shortfall,

your record is typically “Closed Voluntarily,”

not “Default.”

Still, some institutions may be stricter.

Always keep your account closure confirmation letter

for future loan applications.

If your credit report shows inaccurate data,

you can file a correction with the National Credit Bureau.

(Example: The Nine Tower Grand Rama 9, 2nd floor —

bring request form, closure letter, and ID.

Processing time: ~30 days.)

5.1) When declared bankrupt by the Central Bankruptcy Court,

all your assets transfer to the Official Receiver

for liquidation and debt distribution.

Creditors are protected from duplicate enforcement,

and the debtor must follow legal restrictions until discharge.

5.2) Key restrictions:

Property management:

You lose control over your own assets.

Any unauthorized transfer is void.

Travel and residence:

Cannot leave Thailand without written court permission.

Must notify address changes promptly.

Business & professional disqualifications:

Cannot serve as company director or legal manager.

Automatically terminated under Civil and Commercial Code §1154.

Ineligible for political office or licensed professions

(lawyer, auditor, civil servant, etc.) until discharge.

Cooperation duties:

Must disclose assets, debts, income, and documents to the Official Receiver.

Concealment or noncompliance is criminal under the Bankruptcy Act.

New credit:

Financial institutions severely restrict loans and cards

until you’re discharged and rebuild credit history.

Normally, 3 years from the date of adjudication —

if no fraud and full cooperation.

Exceptions extend to 5 years or more

(for repeat or fraudulent cases).

After discharge, all provable debts are cleared —

except tax and fraudulent debts,

which remain collectible.

.

Join the discussion:

https://www.facebook.com/Ex.MatchingProperty/posts/pfbid0Kr6bhTrUd9kNodQQuPZjPq2urk1czncFNmppNVNVdRRpQaRqrRvHfAagvGg1pRTjl