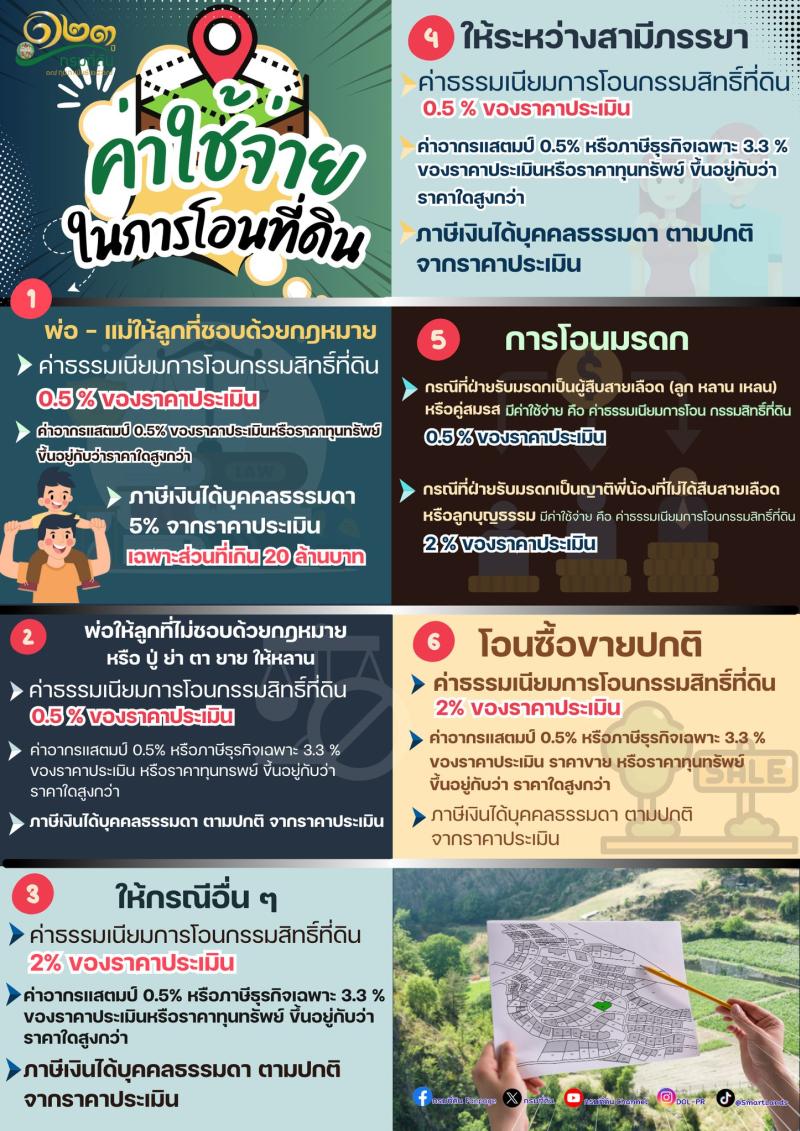

Land Transfer Fees in Thailand: What You Need to Know

Many people still ask about land transfer costs, so here's an updated breakdown of all the necessary fees and taxes when transferring land in Thailand.

1. Transferring Land from Parents to Their Legal Child

- Ownership transfer fee: 0.5% of the appraised value

- Stamp duty: 0.5% of the appraised value or actual price, whichever is higher

- Personal income tax: 5% of the appraised value (only for amounts exceeding 20 million THB)

2. Transferring Land from Parents to an Illegitimate Child or from Grandparents to Grandchildren

- Ownership transfer fee: 0.5% of the appraised value

- Stamp duty: 0.5% of the appraised value or

- Specific business tax: 3.3% of the appraised value or actual price, whichever is higher

- Personal income tax: Calculated based on the appraised value

3. Other Gift Transfers

- Ownership transfer fee: 2% of the appraised value

- Stamp duty: 0.5% of the appraised value or

- Specific business tax: 3.3% of the appraised value or actual price, whichever is higher

- Personal income tax: Calculated based on the appraised value

4. Transfers Between Spouses

- Ownership transfer fee: 0.5% of the appraised value

- Stamp duty: 0.5% of the appraised value or

- Specific business tax: 3.3% of the appraised value or actual price, whichever is higher

- Personal income tax: Calculated based on the appraised value

5. Inheritance Transfers

If the heir is a direct descendant (child, grandchild, great-grandchild, or spouse):

- Ownership transfer fee: 0.5% of the appraised value

If the heir is a relative (sibling, adopted child, etc.) without direct lineage:

- Ownership transfer fee: 2% of the appraised value

6. Regular Sale and Purchase Transfers

- Ownership transfer fee: 2% of the appraised value

- Stamp duty: 0.5% of the appraised value or

- Specific business tax: 3.3% of the appraised value, sale price, or actual price, whichever is higher

- Personal income tax: Calculated based on the appraised value

For the most accurate and up-to-date information, please check with the Department of Lands, Thailand.

#LandOffice #ThailandProperty #LandTransferFees

.

Join the discussion at

https://www.facebook.com/Ex.MatchingProperty/posts/pfbid0C7SfyuYMY151osYQMmx8eLQcTMj5Bbunf9QuVLj13kZgan3y5XMHPMcbBtrBBy6Ml