WeChat ID :

Login/Register

Let me explain a bit about this.

.

#What is Sell with Right of Redemption? #Why do it?

When someone needs a lump sum of money to run a business,

moving money around or finding investment funds

can happen to anyone.

But to ask for funding from someone,

you must have collateral.

For example: gold, cars (with a title), and real estate.

.

Sell with right of redemption usually refers to using real estate as collateral.

Real estate can be any type:

land, houses, condos, warehouses.

.

In Bangkok, almost all types are accepted.

But in the suburbs or upcountry,

they mostly only accept vacant land.

Because it can be used for further benefit.

.

The property title used as collateral

must usually be a clear title deed.

.

Clear title deed means

it has no encumbrance with anyone.

You have full ownership rights

and can transact immediately.

.

If mortgaged to the bank, under court consideration,

or in inheritance settlement,

these do not count as clear title deeds.

.

#Let’s understand some terms

Tidt Sapp (Property Side) =

An agent who knows the landowner directly.

Tidt Thoon (Investor Side) =

An agent who knows the investor directly.

.

Sell with right of redemption / Mortgage =

The landowner needs money

but cannot get a loan from the bank

or gets less than needed.

So they use their land as collateral

to get the funds needed.

.

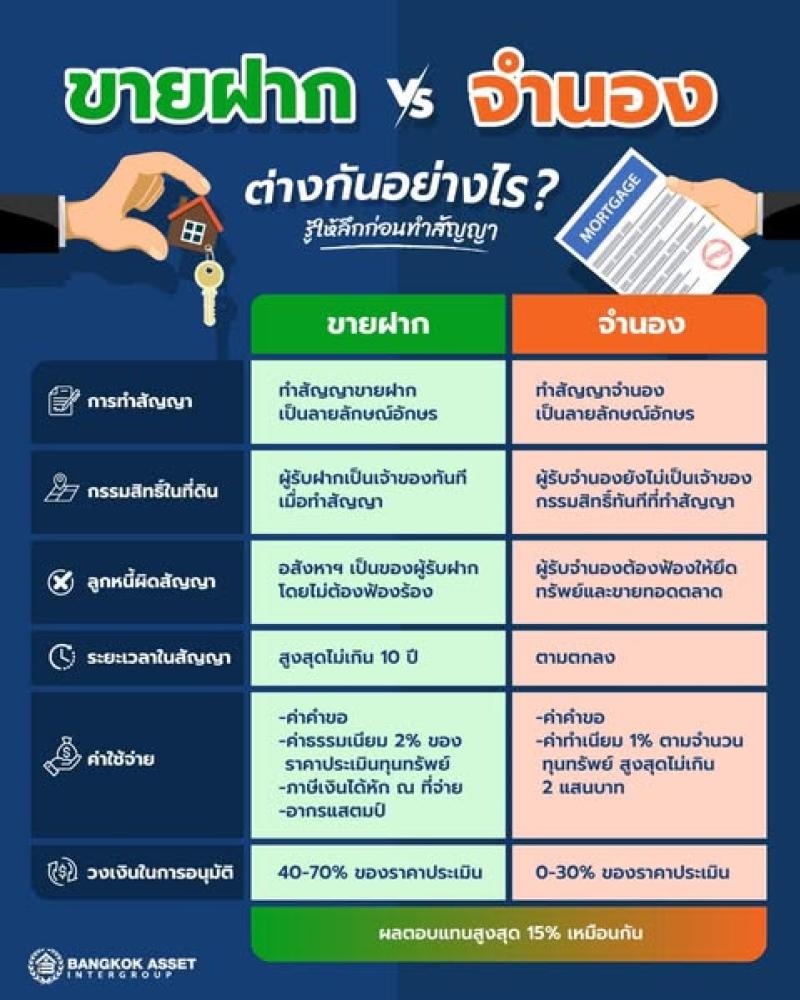

Sell with right of redemption and mortgage

may look similar at first glance

but they have different details.

.

In sell with right of redemption,

the buyer immediately gets ownership of that land.

.

In mortgage,

the buyer does not get ownership (must sue to seize).

.

Landowners like mortgage

because the interest/fees are lower than redemption sales.

But some choose redemption sales

because they can get a higher loan amount.

.

However, investors prefer redemption sales

because if the landowner does not redeem

within the agreed period,

the investor can sell the land immediately

without having to sue as in a mortgage.

At least they get something in hand.

.

Interest rates for redemption sales/mortgage

range from 9-15% per year

(standard legal max interest rate is 15%).

.

Normally, investors don’t really want to seize properties to sell.

They only want interest from the redemption or mortgage.

.

Funding criteria for redemption sales/mortgage

Redemption sales: 40-60% of Land Department’s appraised value.

Mortgage: 30-40% of appraised value.

.

Some might use private appraisal rates.

.

But if the location is hot and in high demand,

they might give 40-60% of the market price.

.

.

.

#Properties that investors do not accept for redemption sales

Hidden full sale price

As mentioned earlier,

investors use Land Department appraisal as the base.

.

So if you send a property

and ask for an amount close to the market price,

it’s basically a full sale price.

These properties often leave investors stuck

and hard to resell.

.

Only a few prime locations,

like early to mid Sukhumvit,

may consider using market price as a base

to compete with other investors.

.

Vacant land with deep water ponds covering half the plot.

Investors can’t utilize it.

Whoever buys must bear the cost of backfilling.

.

Land under Nor Sor 3 Kor title deed

but adjacent to forest reserve.

.

Properties previously pledged in redemption/mortgage

or partial mortgage.

.

No confirmation letter for redemption/mortgage.

Without this letter,

investors rarely visit the site.

They often face last-minute tricks at the Land Office.

.

But if there’s a confirmation letter,

they can notify the officer to enforce redemption.

.

Land under high-voltage power lines.

As in recent news,

the land is useless.

.

Land already pledged to another investor

or fully mortgaged with a bank.

.

Properties where appraisal book value is unusable.

.

Properties circulating online

for over 6 months or over a year.

.

Land with narrow access roads

or easement paths only 3 meters wide.

.

Narrow frontage / insufficient road access

or noodle-like land plots.

.

Land with easement burden for many inner plots.

.

Landlocked plots.

But if easement documents are attached,

it might be reconsidered.

.

Title deed just recently traded within 3 months.

.

Properties with multiple owners

must have consent letters from all.

.

.

.

In the world of mortgage and redemption,

there is no such thing as luck.

Not too hard,

but not as easy as you might think.

.

Any agent wanting to handle redemption sales

must understand the area

and have a certain level of pricing data.

.

You need to know

which investor accepts what type of property,

in which areas,

and for how much.

.

Because each investor

has different preferences and specialties.

For example:

Investor A likes condos,

housing projects, or land subdivisions in Bangkok,

budget no more than 10 million.

.

Investor B likes vacant land

in provincial cities,

budget no more than 5 million.

.

Investor C likes houses/land

only in Sukhumvit zone,

budget can exceed 100 million.

.

Having property data alone is not enough.

You must also have investor data.

So you can screen properties properly for them.

.

If you only forward without pre-screening,

most will be junk properties.

Investors will see you as unprofessional.

Your properties will lose appeal.

.

Worst case: same property sent by multiple agents,

and the investor chooses to work with someone else.

.

Therefore,

emphasize working professionally.

Analyze the property, location, price for them.

Summarize clearly.

This shortens their decision time

and you get paid faster too.

.

There are investors everywhere, lots of them.

How brightly you shine for them

is your homework to prove yourself.

.

Once enough investors approach you,

that is a gold mine.

You will have endless income from redemption deals.

.

.

.

Need liquidity? Want to do redemption sale?

To fund your business.

.

Buy, sell, rent all types of properties

in Bangkok and surrounding areas.

.

Redemption sale / Mortgage

1–1,000 million baht.

.

Debt settlement with banks.

Property buy-out to relieve burden.

.

Complete all property transactions.

Need advice? DM us.

.

.

.

CR.

Some information from Khun Tom

Photos by Sansiri and Bangkok Asset.

.

Join the conversation at